Rich Dad Poor Dad In One Sentence

Rich Dad Poor Dad offers the financial education we should have been taught in school, breaking down the differences between how the rich and the poor think about and spend their money.

Rich Dad Poor Dad Summary

Robert Kiyosaki as a young boy had the benefit of listening to his own Dad who struggled financially, he was academically smart and followed the system. He also took advice from his friend’s dad who was a high school dropout that became one of the richest men in Hawaii, he was financially savvy but didn’t value the academic education that his own dad swore by.

Being in a situation where he can pick and choose whom he listens to. Robert and his friend later chose to work for his ‘rich dad’, who teaches them to work for knowledge and to get over their fear and greed which becomes a part of any employee’s biology.

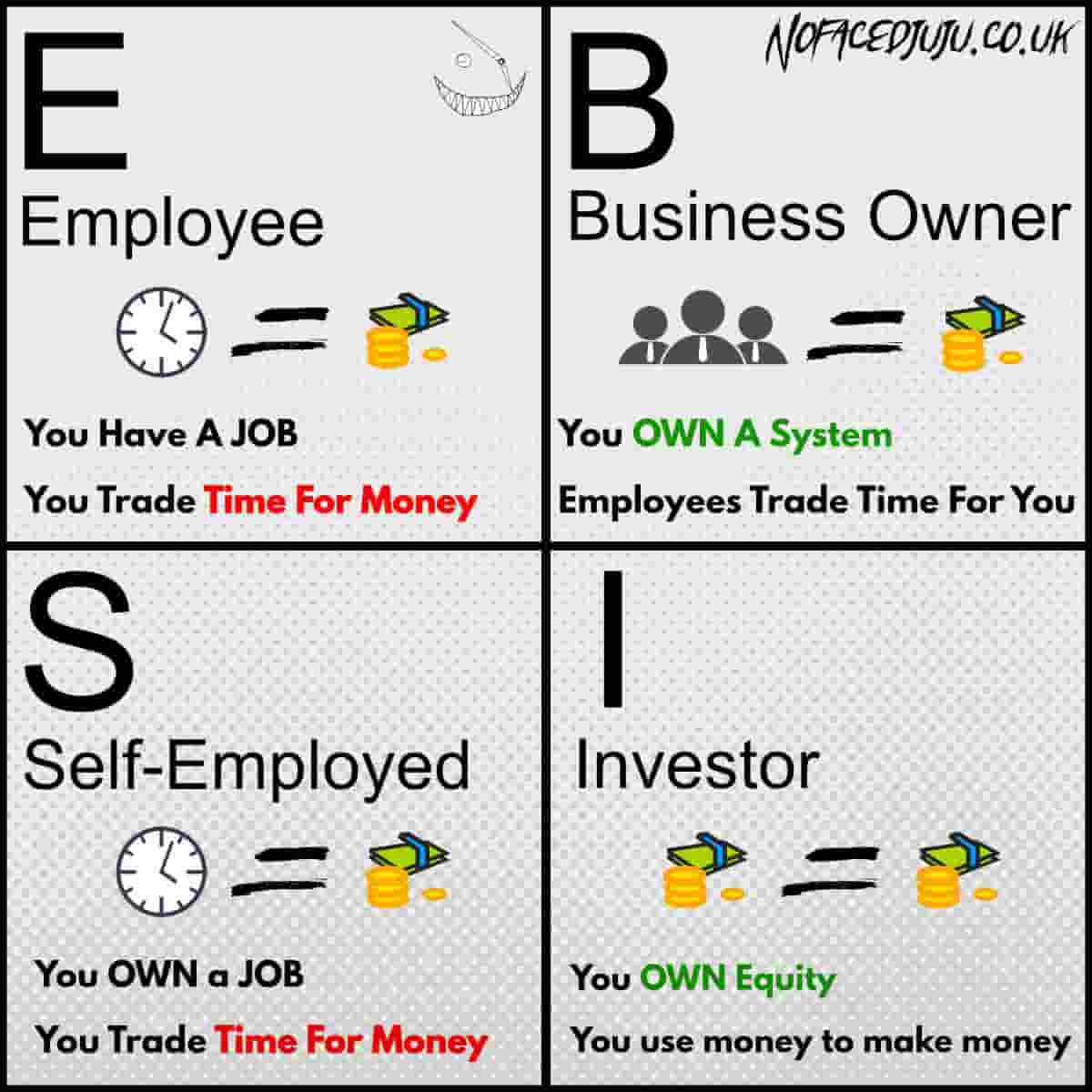

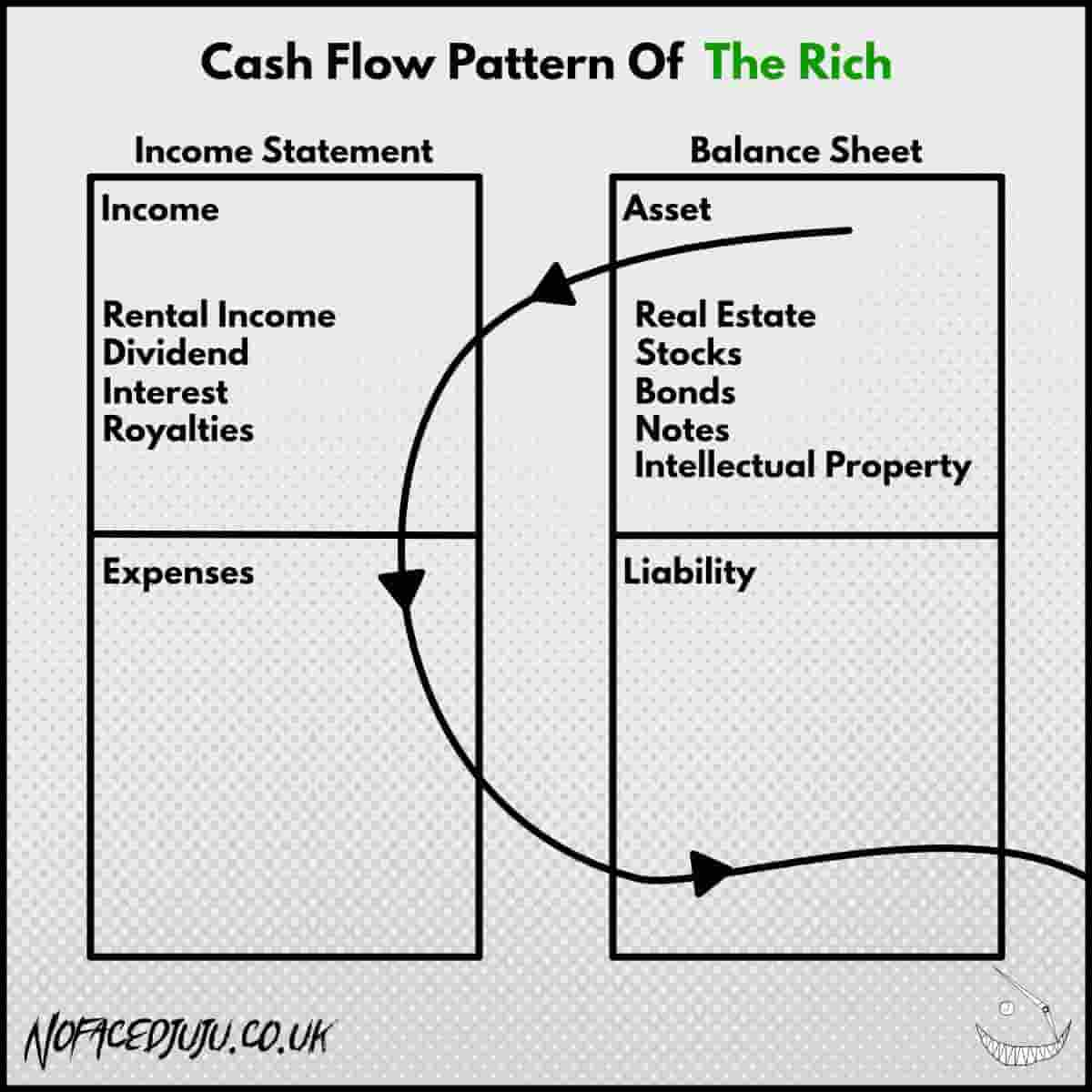

Robert explains the pros & cons of the “cashflow quadrant” which includes an employee, someone who is self-employed, a business owner, and an investor, by showing income statements and balance sheets of each quadrant. This highlights the differences between the rich & the poor, not only their spending habits but also their mindset, their attitude to work & how to transition from trading your time for money to having financial freedom by leveraging the same system the rich use to get ahead.

Top Takeaways From Rich Dad Poor Dad

The Cashflow Quadrant – escaping from the rat race

An employee has to work more or increase their value to the company to get a raise or a promotion, as their income increases usually so do their spending habits, such as upgrading their car, phone, house, etc.

Which then leads them to need another raise or promotion to keep up with their new expenses. Employees are taxed before the money ever hits their account & the biggest concern is they can work for the same company for 20 years, the company could close down or lay people off, leaving them back at square one, with no job or income to cover their lavish new lifestyle.

Someone who is self-employed is in charge of their own career, they have the benefit of spending their money first and paying taxes later, which gives them the opportunity to reinvest that money into the business which in turn could increase revenue, they’re able to reinvest all year long and pay any taxes owed at the end of the year, smart accounting can reduce your tax bill to nothing and encourage business growth & re-investment.

For example, instead of paying a large tax bill at the end of the year, that money could be used to invest into 1 year’s rent for a warehouse, 2000 units of stock, merchandise, etc.

The risk of being self-employed is you are in charge of your income if you don’t work you don’t get paid, if you get injured and out of work for a couple of weeks, then say goodbye to your income.

A business owner has even more tax benefits, instead of being paid as an employee via PAYE, they can get paid in dividends which are taxed at a much lower rate, and the business is also taxed at a much lower rate. A business is also classed as its own entity, so if you we’re to get sued your personal belongings are safe, which isn’t the case if your self employed.

Being a business owner you’re able to automate the system via employees, you are in charge of the day-to-day operations and paying your employees. Now you have the option to have the day off without it affecting operations and your income, without employees you can’t achieve true passive income and financial freedom, but don’t forget these people now rely on you for their livelihood & that can come with a lot of added pressure.

An investor is someone who puts their money to work for them, usually investing in a business via stocks & shares or even cryptocurrency.

When investing you can see your money grow if the value of the company you choose to invest in grows in value.

You can even invest in companies that pay out dividends, which is a passive income for your investment.

With the potential for high returns comes high risk. When 50% of your net worth is invested in other companies you have to keep up with the news, the global markets & understand economics, it’s quite surprising how all the markets react & respond to each other.

The goal of the quadrant, is to move away from trading your time for money to using your money to create income passively, ultimately giving you lifestyle freedom. As an employee your work for the stockholders, the business owner, and the taxman to make them all rich, if you have a mortgage you also work for the bank. As an employee, you can simply imagine your first 10 weeks in a year are owed to the government in taxes. How many weeks per year on top of that do you work for your mortgage and your car?

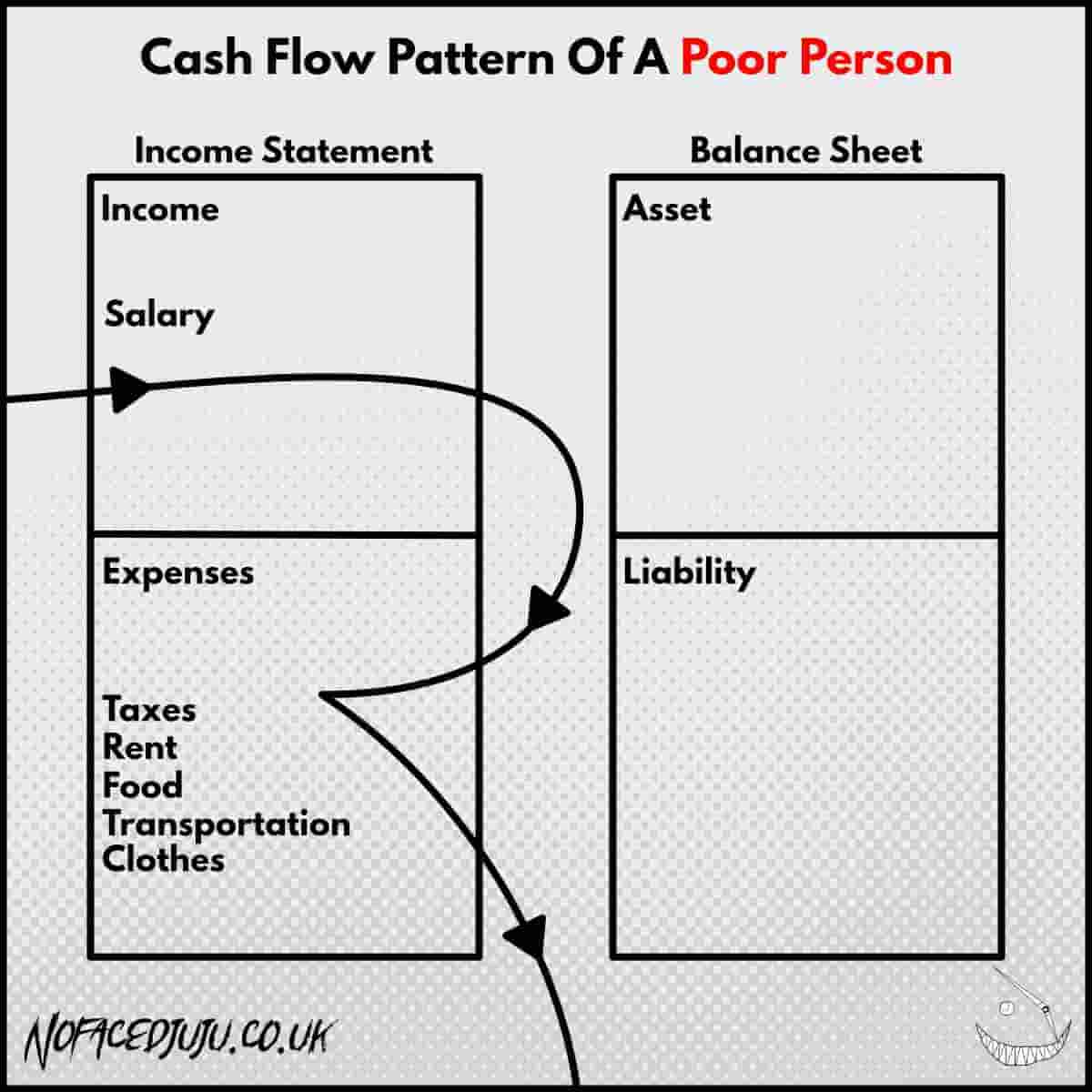

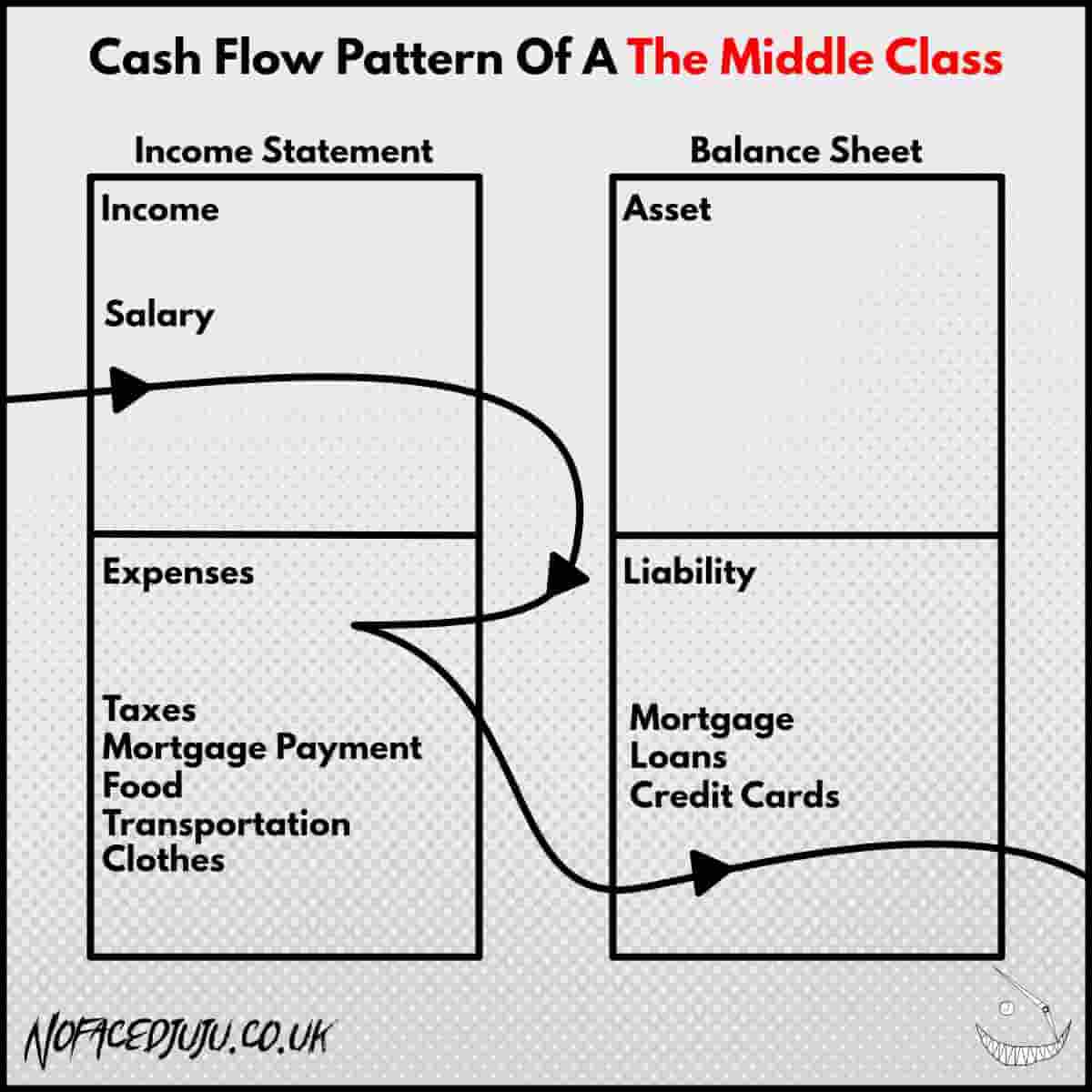

Assets + liabilities

Assets put money in your pocket and generate income.

liabilities take money out of your pocket by generating expenses.

Rich people focus on acquiring assets, while the poor and middle-class acquire liabilities that they think are assets.

Your home is not an asset, you have mortgage payments, interest on that mortgage, expenses for repair, and utilities such as electricity, water, etc.

The big problem with taking on a house early in life is the cost of all your missed opportunities, instead of investing in income-generating assets, your paying off your mortgage loan and paying for upkeep with no guarantee that the value of your house will increase in price.

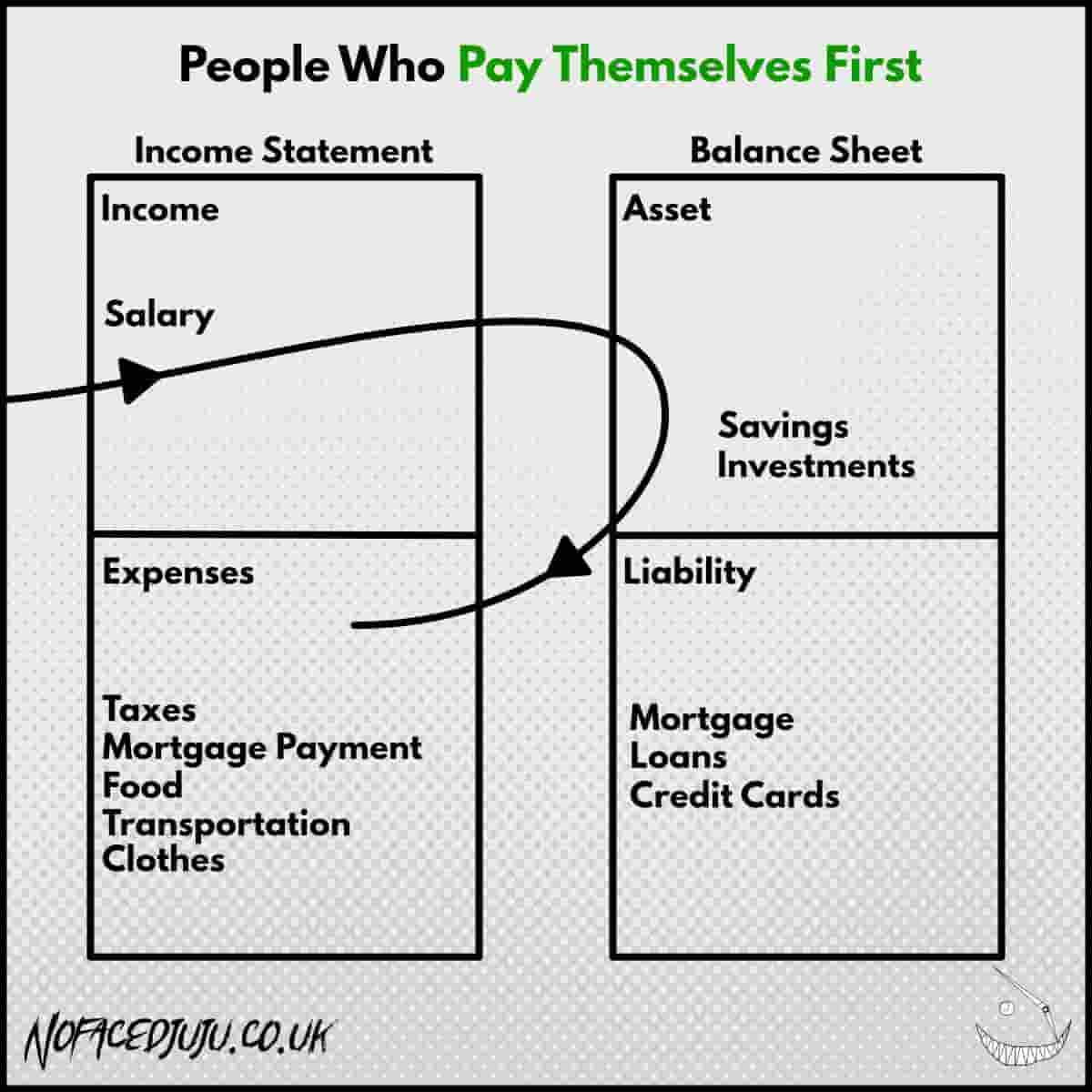

Instead, you can turn a house into an asset by purchasing it as a business then renting it out to someone, on a good deal your income from rent should pay the mortgage, cover any maintenance costs and give you some positive cash flow, leaving you with some money in the bank and a house once the mortgage is kindly paid by the tenant

Top Quotes From Rich Dad Poor Dad

- Financial intelligence is made up of four main technical skills –

Accounting, Investing, understanding markets & the law.

- Job is an acronym for “Just over broke”

- “Rich dad believed that the words “I can’t afford it” shut down your brain, whereas “how can I afford it, opens up possibilities, excitement & dreams”

- The main management skills needed for success are” the management of cash flow, the management of systems & The management of people

- There is a difference between being broke & poor, broke is temporary, poor is eternal”

- “it’s not how much money you make, it’s how much money you keep”

- The wealthy see work as an opportunity to learn, not for money

- Business owners who own corporations – 1. Earn 2. Spend 3. Pay Taxes

- Employees who work for corporations 1. Earn 2. Pay Taxes 3. Spend

- Pay yourself first

Actionable Advice From Rich Dad Poor Dad

- Work out your income statement – add your income, monthly expenses, assets, & liabilities.

Try to lower your expenses, remove some liabilities & see if you can put something to the side each month for investing or starting a new business venture.

- Learn to account, understand what is a valid business expense and what is not allowed, later get into the more advanced stuff like depreciation, and learn the difference between cash basis accounting and traditional accounting.

- Switch your thinking from “I can’t afford that” to “how can I afford that?”

- Think of each £1 you own as an employee working for you, how can you put yours to work?

My Final Thoughts On Rich Dad Poor Dad

Rich Dad Poor Dad was the book that changed everything for me, after being arrested for selling class A drugs at 17 I locked myself away, read Rich Dad Poor Dad and I was completely dumbfounded, how could this information be so valuable, important & not a single teacher has uttered a single word to me about business, taxes, investing, etc.

At this point I started to question everything, I was amazed that if this information exists and teachers didn’t preach it to us, they probably didn’t know and we’re likely trapped in the rat race too, who else have I been taking advice from that doesn’t understand this stuff. It really sparked my curiosity and ignited my passion for learning after school, this kind of learning was something that could actually impact my life.

At 25 I quit working as an employee and haven’t worked for anyone else since.

I run a reselling business which gives me a lot of freedom for reading, writing, producing music, and making art.

in 2017 my friend and I dabbled in business, we started an e-commerce website & managed to gross just under 1.5 million in our first year using free wi-fi from libraries and coffee shops, which would have never happened If we’d not stumbled upon this book.

Personally, I think rich dad poor dad is a must-read for anyone, especially if you’re working a 9-5.

0 Comments